DuPont’s Effect on Gap Inc.

May 6, 2012

by Talia Lambarki, MBA

The DuPont method of analysis is a method of measuring company performance that originated from the DuPont Corporation in the early 1900s. The operating efficiency (as measured by profit margin), asset use (as measured by total asset turnover), and financial leverage (as measured by equity) are analyzed to determine their effect on ROE. If the ROE is considered too low, the DuPont analysis can be used to identify the areas of underperformance.

A DuPont analysis of the Gap reveals the factors that contributed to the high ROE of 30%. In fact, the company maintained superior returns during the years 2008 through 2010. The average standard ROE is in the range of 12% to 15%. Gap’s ROE increased from 22% in 2008, to 23% in 2009, to 30% in 2010 (for a three-year average of 25%). The upward trend and high ROE for the three years indicates superior performance, which should attract investors to fund company projects that will further increase profitability.

In contrast, Abercrombie & Fitch and American Eagle suffered below average returns (ROE of 8% and 11%, respectively for the years 2008 through 2010). The returns of both companies also decreased from 2008 to 2009. If the Gap can sustain its strong financial stance, and even grow stronger, it will continue to be a formidable market leader in the United States.

Gap Inc. Revenue Recap

May 6, 2012

by Talia Lambarki, MBA

“The Gap, Inc. is a global specialty retailer offering apparel, accessories, and personal care products for men, women, children, and babies under the Gap, Old Navy, Banana Republic, Piperlime, and Athleta brands…The Company operates in two segments: Stores, which includes the results of the retail stores for Gap, Old Navy, and Banana Republic, and Direct, which includes the results for its online brands, both domestic and international.” (Gap Inc. 2011 Disclosure). The stores segment contributes 91% of net sales for the company, while the direct segment contributes 9%.

In 2007, total revenue from both segments was $15.8 billion, the gross profit was $5.7 billion, and net income was $833 million. In 2008, revenue declined to $14.5 billion, gross profit dropped to $5.5 billion, but the net profit rose to $967 million as a result of eliminating long-term debt, which was a strategy implemented in 2002, and opening franchised stores in the Middle East and Asia. The recession in the U.S. contributed to the decline of revenues. In 2009, revenues continued to decline to $14.2 billion. However, the gross profit rose to $5.7 billion, and the net profit rose to $1.1 billion. From there, revenue went on to increase by 3.3%, for a total of $14.7 billion by the end of year 2010. As a result, their net profit increased by about 9% to $12 billion.

It is in the best interest of Gap management to continue upward trends, especially since the company operates in such a competitive industry. However, revenue does not always trend upward, it fluctuates. There was a decline in revenue of about 0.8% or $14.5 billion for FY2011 compared to the prior year. Nonetheless, the company’s profitability can still be used to fuel further global expansion, product development and innovation, and advertising efforts for revenue growth.

by Talia Lambarki, MBA

Gap Inc. has a strong market presence domestically; however, it lags behind global competitors. One of its domestic competitors, TJX Companies, leads Gap globally in market share. The market shares of the top four companies, based on the revenues of each compared to the revenues of the industry segment, are used in the Herfindahl-Hirschman index to determine their sizes relative to and impacts on domestic and global markets.

Domestic Market Share

In the United States, 39.6% of the family clothing store industry (NAICS 44814) consists of four companies, which include Gap, TJX Companies, Ross Stores, and Abercrombie & Fitch. Total revenue for the industry was $85.8 billion in 2011. Gap Inc. holds the most dominant position in the industry, with a total domestic market share of 13.3%.

Even though Gap’s share of the whole market is a small piece of the pie, it has a strong hold on the market. The family clothing industry is very fragmented. Most companies (60.4% of them) hold a very small share of the market. This share may even be less than 1%. “Over 80% of firms operating within the industry employ four or fewer people, so no single company owns a substantial portion of the market” (IBISWorld Industry Reports). Therefore, a company, such as Gap, that represents 13.3% of the market is a formidable giant compared to the many smaller companies that represent less than 1% and are trying to compete.

Global Market Share

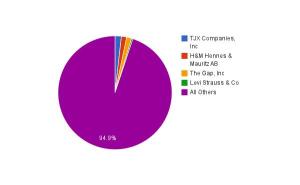

One way for companies to gain access to new customers is to expand into international markets. Global expansion is an attractive option when home markets are mature such as the family clothing stores industry in which the Gap operates. The global apparel retail industry had revenues totaling $1,031.5 billion in 2009, based on the most current global industry report. According to Datamonitor, the four major global competitors in the industry are the TJX Companies Inc with $19 billion in revenue (1.8%), H&M Hennes & Mauritz AB with $15.49 billion in revenue (1.5%), Gap Inc with $14.526 billion in revenue (1.4%), and Levi Strauss & Co with $4.023 billion in revenue (0.39%).

Herfindahl-Hirschman Index: U.S. Family Clothing Stores

The Herfindahl-Hirschman index (HHI) is used to compare the size of firms in relation to the industry. The index indicates the level of competition among the firms in the industry. The HHI is defined as the sum of the squares of the largest firms by market share within the industry. The highest HHI value is 10,000, which indicates a monopoly.

A decrease in the number of competitors results in an increase in the HHI value for a firm. Likewise, an increase in the number of competitors decreases the HHI.

Using the four major players in the family clothing stores industry (Gap, TJX Companies, Ross Stores, and Abercrombie & Fitch) the HHI is calculated as follows:

HHI = 13.32 + 12.52 + 9.82 + 4.02

HHI = 176.89 + 156.25 + 96.04 + 16

HHI = 445.18

The value of 445.18 out of 10,000 indicates that the industry is very competitive, having few dominant players. As the industry expands and grows more competitive (firms enter the industry), the HHI decreases.

Herfindahl-Hirschman Index: Global Apparel Retail

The Herfindahl-Hirschman Index (HHI) can also be used to measure the size of firms in the global industry. Using the four major players, the HHI for the global apparel retail industry is calculated as follows:

HHI = 1.82 + 1.52 + 1.42 + 0.392

HHI = 3.24 + 2.25 + 1.96 + 0.15

HHI = 7.6

An HHI value of 7.6 indicates the global retail industry is very competitive, having many participants without any significant dominance. The global industry is over 58 times more competitive than the domestic market, which places much higher on the HHI (at 445.18).

Bridging the Gap

By further leveraging its competitively valuable resources and increasing its capabilities, it is possible for the Gap to extend its market-leading position in its domestic market into a position of global leadership. It is becoming increasingly important for many firms to expand their global presence or enter into global markets to remain competitive and stay afloat. Accordingly, the Gap is continuing to expand its global market share. In 2009, the company had plans of doubling its revenue from $1 million to $2 million. By the end of 2011, it was on track toward realizing that goal and bridging the gap between its domestic and global positioning.